Petty Cash Book: Definition, Features Example, Format ..

This may often require a company to hire an accountant capable of managing these accounts. Doing this might not be a problem for some businesses but may be seen as an additional expense for the company. There’s a potential risk of funds being used for unauthorized or personal expenses. This makes it very important to put stringent measures in place so as to prevent financial impropriety. Clear documentation and a fixed fund amount provide transparency into how petty cash is utilized, aiding in internal oversight and external audits. Regular replenishments and a clear understanding of petty cash usage contribute to a more precise assessment of cash inflows and outflows.

Facilitates verification and auditing process

Also notice that on March 1, the cash amounting to $200 was added to the balance of $50 to restore the float. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Ask a question about your financial situation providing as much detail as possible. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

AccountingTools

These regular audits will help to avoid any errors or loopholes in the system. Along with the regular ones, the head accountant or financial manager must sometimes call for surprise checks as well. To ensure fraud aversion and avoid overspending, putting a ceiling limit on each petty expense category or type is essential. Companies should harness the power of mobile app versions of their petty cash systems to bolster communication and oversight. While small expenses may not be considered very important to take note of, they can add up over time and have a significant impact on the finances of the company.

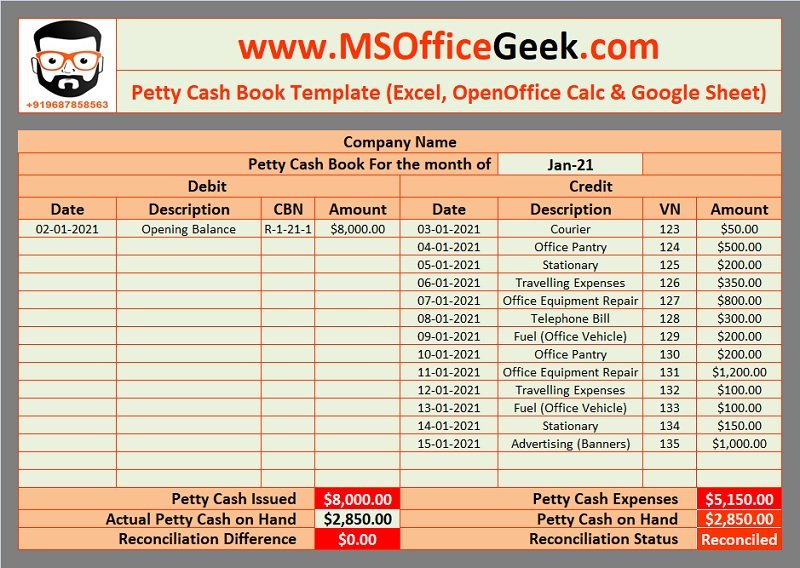

- Petty cash books are prepared using the ordinary system and imprest system.

- After exhausting the amount, the petty cash cashier will submit the account for the money and will be given money for the next period.

- Small payments are often needed for postage, delivery charges, office supplies, or entertainment expenses.

- When the petty cash book is constantly updated and maintained properly on a regular basis, then the reimbursement of employee expenses can also happen faster.

Analytical Petty Cash Book

Automated systems provide continuous tracking of expenditures, offering immediate awareness of how funds are utilized. This real-time monitoring enhances control and facilitates timely decision-making based on current financial data. Neglecting regular reviews of the petty cash book can lead to discrepancies and oversight. There might be errors in data entry or compliance issues that are causing trouble in the finances of the company. Regular reconciliation transforms data into insights, offering a nuanced understanding of spending patterns. This knowledge becomes a strategic asset, allowing organizations to make informed decisions and adjust budgets based on observed trends in petty cash expenditures.

The theory is that seeing those photos encourages people to behave more ethically. Journal entry posted in the Postage account on the debit side by writing “To Petty Cash A/c”. Journal entry posted in the Cartage account on the debit side by writing “To Petty Cash and fees deduction A/c”. Journal entry posted in the Stationery account on the debit side by writing “To Petty Cash A/c”. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Appoint a trustworthy individual as the custodian who will be responsible for managing the petty cash fund. To learn more about how Pluto can enhance your petty cash management processes, book a demo and discover the benefits of a fully digital approach. The flexibility of digital systems also allows for customization to fit your specific petty cash management needs. As your organization grows, a digital petty cash book easily scales to accommodate increased transaction volumes and additional users. It also integrates seamlessly with accounting software, providing an efficient way to handle petty cash without the hassle of manual entries.

From the initiation of the journal, the ledger account is prepared, with the help of which the final books of accounts of the company are prepared. In contrast, the petty cash book records the transactions related to the cash account. A petty cash book is a manual system recording expenditure and is often prone to errors. It also becomes cumbersome to keep the books and record each transaction, especially in big companies.

This segment underscores the significance of this process in maintaining accuracy, accountability, and financial transparency within an organization. Missing data can be a pain for the finance team as they won’t be able to log those entries in the accounting system. Regular monitoring by the petty cash custodian ensures accuracy and transparency in financial records. The columnar petty cash book provides more comprehensive details regarding spending patterns and facilitates proper maintenance of numerous minor expenditures in an orderly fashion by businesses.

Under the fixed system of petty cash, a fixed amount is given to the petty cashier for a fixed period of time. In all businesses, some payments are made by check for better control over cash. However, for the payment of small expenditures (e.g., stationery, travel, postage, and newspapers), paying by check is unreasonable.

At the same time, it will show a credit of that same amount to your bank account. You must create journal entries that monitor and record all petty cash transactions, just like any other transaction. These transactions should be present on your financial statements and recorded in a manner that oversees the replenishment of your funds. While the actual funding should be recorded, the individual purchases do not need to be officially recorded. If petty cash doesn’t reconcile, check for common issues like missing receipts, math errors, or unrecorded transactions. Count the cash carefully, review the log, and speak with anyone who recently accessed the fund.